-

Product Capabilities

-

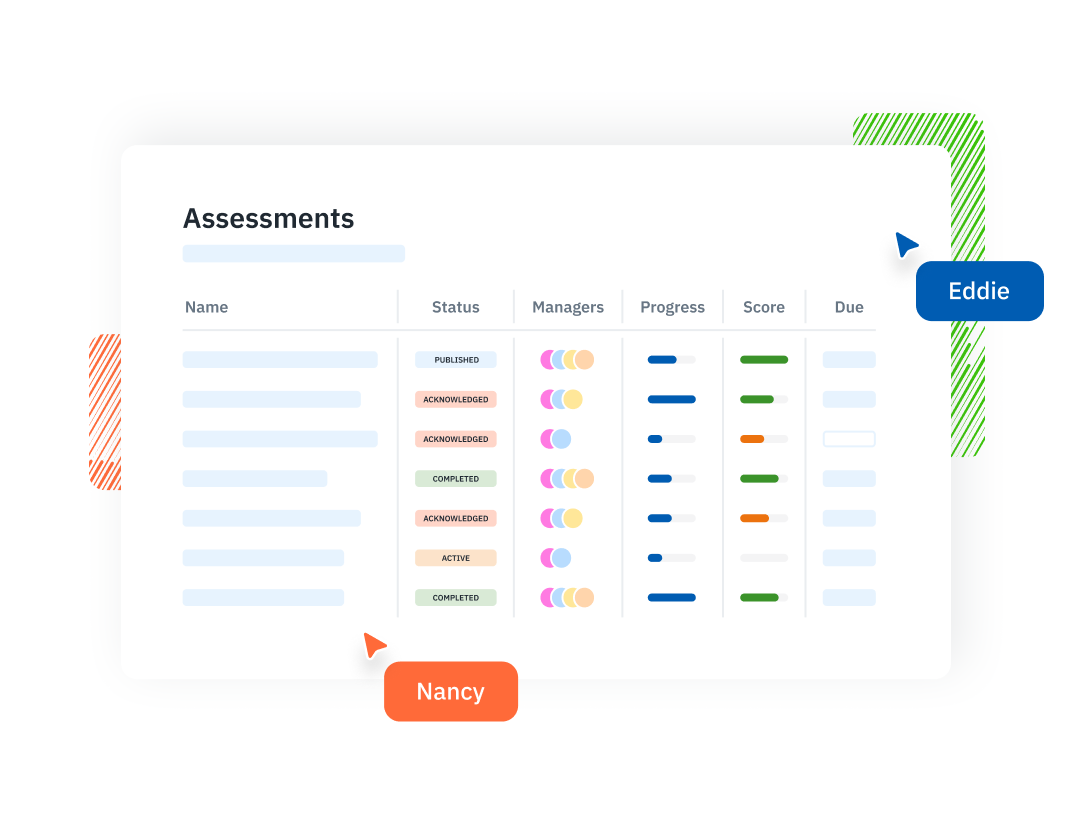

Assessment Management Run structured security assessments across systems, teams, and vendors—all from one place.

-

Questionnaires & Surveys Collect the evidence you need with targeted questionnaires tailored to compliance and risk workflows.

-

Reports & Scorecards Turn assessments into audit-ready reports and actionable insights your team can actually use.

-

Inventory Management Maintain real-time inventories of IT assets, systems, and third parties to support risk and compliance.

-

Exception Management Log, track, and resolve policy exceptions so nothing falls through the cracks during audits.

-

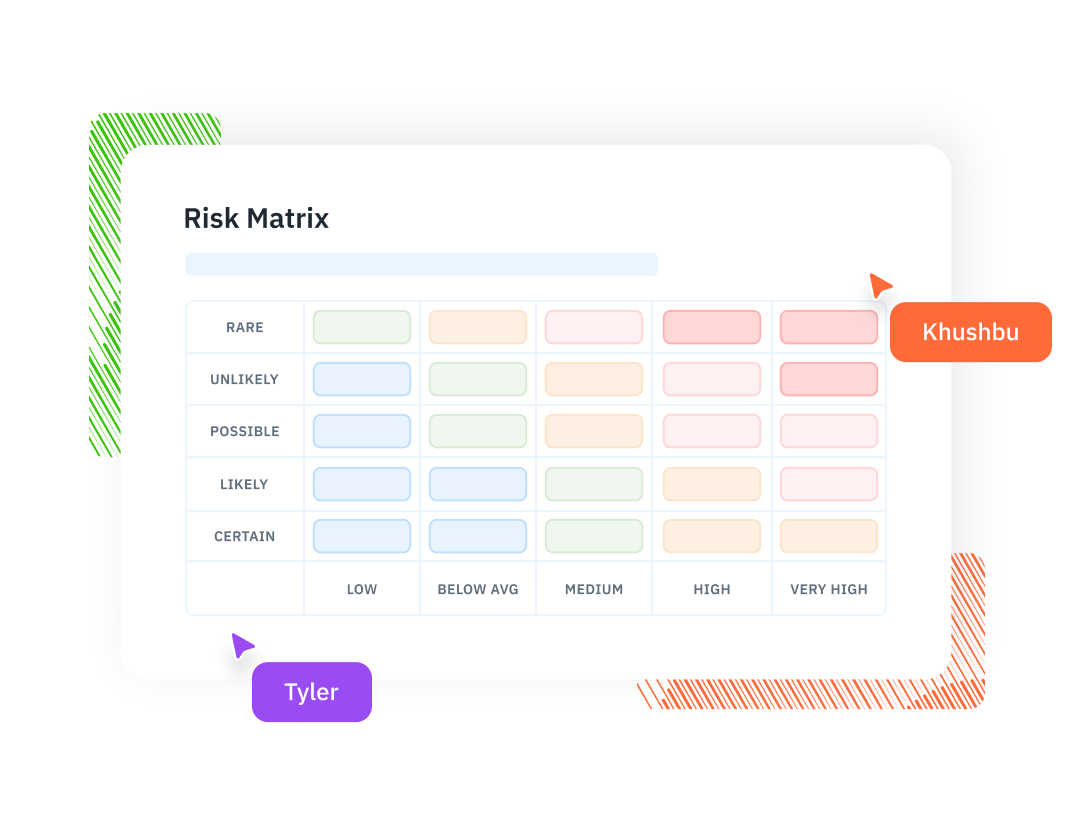

Risk Management Identify, document, and mitigate security risks with workflows that bring clarity and accountability.

Use Cases-

Information Security Risk Management (ISRM) Run assessments across units and systems, maintain IT asset inventories, and collaborate on a shared risk register—all in one place.

-

Third-Party Security Risk Management (TPSRM) Track vendors, send security questionnaires, and manage third-party risk with built-in workflows and a centralized inventory.

This guide contains everything you need to know about conducting an information security risk assessment questionnaire at your organization.

-

-

Solutions FrameworksIndustries

-

Insights Latest ContentLatest Content

- Customer Stories