Managing IT risk within the financial sector has become increasingly complex, driven by rigorous compliance standards such as the GLBA Safeguards Rule and frequent audits by regulatory agencies including the FFIEC, FDIC, FRB, OCC, NCUA, CFPB, and FTC. Banks and credit unions require specialized IT GRC tools to streamline their security assessments, manage third-party risk, and support cybersecurity compliance at regional, national, and global scales.

In this guide, we’ve highlighted the top IT risk and compliance software solutions that enable financial institutions to conduct thorough security risk assessments, maintain comprehensive IT asset inventories, and simplify audit preparations—all while engaging teams across your organization effectively.

What to Look For in IT Risk Management Software for Financial Services Organizations

| Workflow Capability | Why It Matters for Banks & Credit Unions |

| Assessment Management | Automates structured security risk assessments aligned with GLBA Safeguards Rule, FFIEC guidelines, and specific regulatory demands (FDIC, OCC, CFPB, NCUA). |

| Questionnaire Delivery & Completion | Efficiently delivers and tracks security questionnaires for internal units and third-party vendors, streamlining compliance efforts for banking regulations. |

| Inventory Tracking | Centralizes comprehensive IT asset and vendor inventories, supporting accurate risk management across regional, national, or global banking institutions. |

| Risk Register & Exception Management | Enables systematic documentation and resolution of identified risks and exceptions, simplifying compliance reporting and audit readiness (FFIEC, FDIC, OCC). |

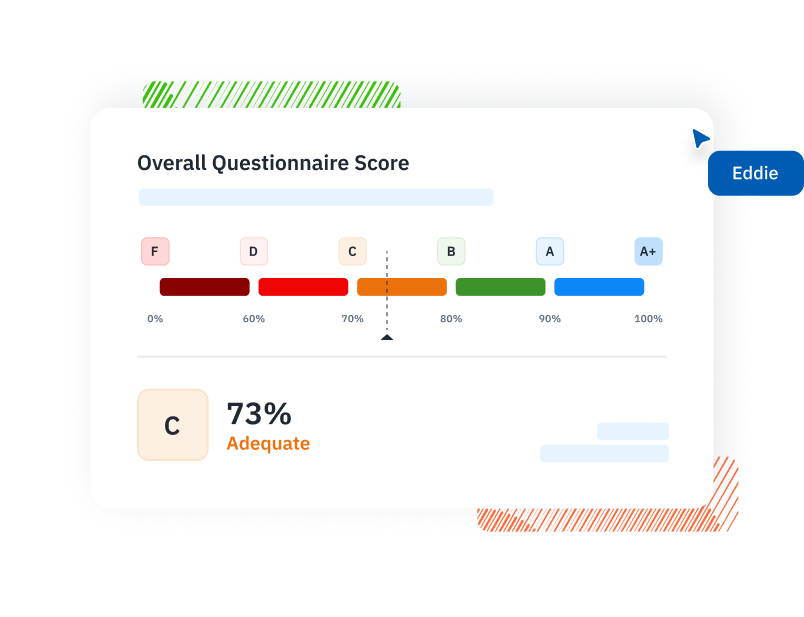

| Scoring, Reporting & Risk Visualization | Provides clear, actionable risk scoring, compliance reporting, and visualizations tailored specifically for banking regulatory audits and internal compliance teams. |

| Collaboration & User Experience | Ensures intuitive usability across departments (IT, compliance, audit, business units), increasing cross-team engagement essential for regulatory adherence. |

| Implementation & Setup | Offers rapid deployment capabilities, allowing banks to achieve immediate value without heavy IT investment or extended consulting engagements. |

Top 5 Best IT Risk Management Tools for Banks & Credit Unions in 2025

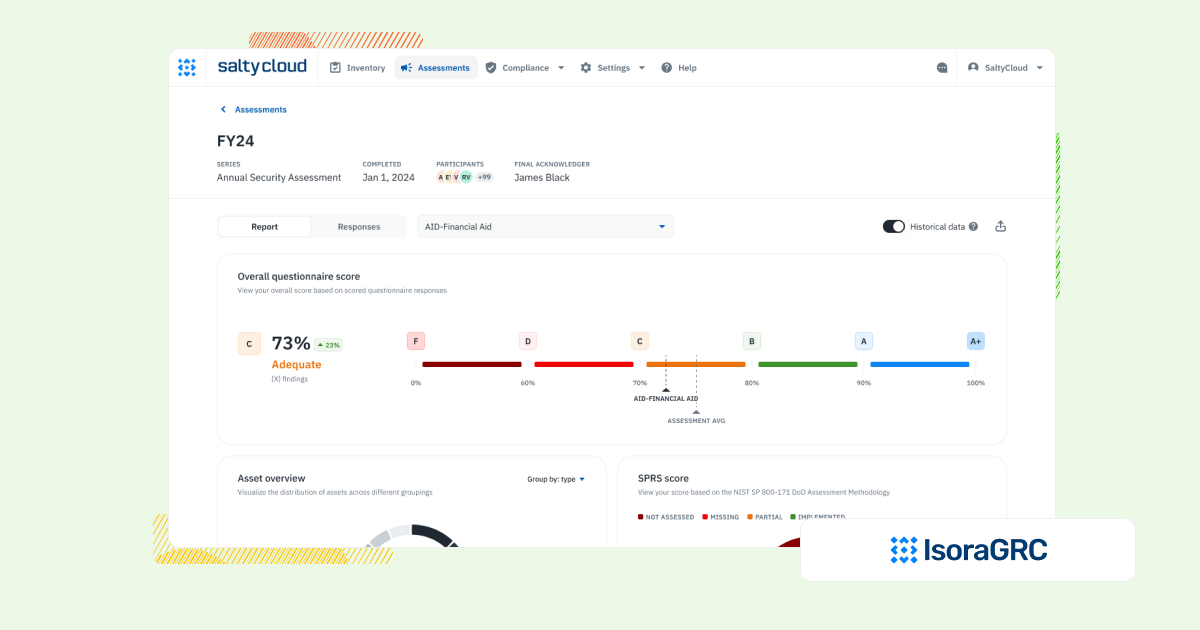

1. Isora GRC

| Category | Details |

| Best For | Banks & credit unions needing an intuitive IT risk management tool tailored for cybersecurity compliance and vendor oversight. |

| Overview | Isora GRC provides financial institutions with a collaborative platform designed specifically for IT risk assessments, IT asset management, regulatory compliance, and third-party risk tracking. Trusted by regulated organizations, it integrates seamlessly into banking workflows to simplify complex risk management processes. |

| Strengths | Built specifically for bank & credit union workflows

✅ Supports structured security risk assessments and aligns directly with the GLBA Safeguards Rule and FFIEC standards. Designed for organization-wide adoption ✅ WCAG-compliant, intuitive user experience ensures high adoption rates across technical and business stakeholders. Rapid implementation and clear value ✅ Go live in days or weeks with minimal IT involvement, providing immediate value for teams needing efficient IT risk management. Flexible, configurable IT risk management ✅ Easily customizable workspaces for assessments, framework questionnaires, asset inventories, risk registers, and reports. Scales across departments and vendors ✅ Unified platform streamlines vendor management and internal risk assessments, aligning with regulatory audit requirements. |

| Limitations | ⚠️ Not designed for broad enterprise GRC outside of IT/security, also referred to as integrated risk management (IRM)

⚠️ Lighter on legal or audit-only features |

| When to Consider | Ideal when transitioning from legacy platforms, spreadsheets, or inflexible audit software to a tool supporting comprehensive risk management across departments. |

2. Archer IRM

| Category | Details |

| Best For | Large financial institutions with dedicated risk teams and the resources to manage complex, custom GRC setups. |

| Overview | Archer IRM is a broad enterprise GRC platform used by large banks to manage risk, compliance, and audits across departments. While it’s powerful, it often requires heavy configuration and outside support, making it harder for smaller or mid-sized banks to adopt. |

| Strengths | ✅ Supports detailed IT risk and compliance workflows for large-scale operations

✅ Useful for managing multiple frameworks, including FFIEC and GLBA requirements |

| Limitations | ⚠️ Complex setup and high cost of ownership; often requires consultants

⚠️ Designed more for enterprise-wide governance than focused IT risk management |

| When to Consider | If your bank or credit union needs a highly customizable IT GRC tool for financial services, and you have the staff and budget to support it long-term. |

| Other Comparisons | Archer IRM vs ServiceNow GRC vs Isora GRC

LogicGate vs Archer IRM vs Isora GRC ZenGRC vs Archer IRM vs Isora GRC |

3. MetricStream

| Category | Details |

| Best For | Large banks and global financial institutions that need to centralize risk and compliance across many departments. |

| Overview | MetricStream is a well-known enterprise GRC platform used by big financial firms to manage risk, compliance, and audits. While it covers many regulatory areas, it often feels too heavy and complex for IT and security teams focused on day-to-day risk assessments or GLBA Safeguards Rule compliance. |

| Strengths | ✅ Designed to support large-scale financial compliance needs like FFIEC, FDIC, OCC, and NCUA audits

✅ Covers a wide range of risk types, including operational, legal, and IT risk assessments |

| Limitations | ⚠️ Long setup times and high complexity slow down IT and security teams

⚠️ Not ideal for focused security risk assessments in banking systems or quick updates across departments |

| When to Consider | If your institution needs an all-in-one IT risk and compliance software for regional or global banks, and can manage the complexity of setup and configuration. |

| Other Comparisons | MetricStream vs SAP GRC vs Isora GRC |

4. Quantivate

| Category | Details |

| Best For | Small banks and credit unions looking for a simple, low-cost tool to get started with IT risk management and compliance. |

| Overview | Quantivate offers basic IT risk and compliance software for banks and credit unions, with tools for policy tracking, audits, and risk registers. It works for smaller institutions, but lacks the depth and flexibility larger or fast-growing teams often need. |

| Strengths | ✅ Covers essential areas like risk registers and policy management for financial sector compliance

✅ Designed with banks and credit unions in mind, including support for FFIEC and GLBA Safeguards Rule requirements |

| Limitations | ⚠️ Limited customization and automation for security risk assessments in banking systems

⚠️ Tools can feel basic and may not scale well with growing IT or cybersecurity programs |

| When to Consider | If you’re a smaller financial institution looking for an affordable way to manage IT risk assessments and compliance tasks, but don’t need advanced features for vendor management or IT asset inventories. |

| Other Comparisons | Quantivate vs LogicManager vs Isora GRC |

5. LogicManager

| Category | Details |

| Best For | Mid-sized banks and credit unions looking for a guided platform to manage early-stage IT risk and compliance workflows. |

| Overview | LogicManager is a well-known IT GRC tool for financial services that offers a mix of templates and support to help teams manage GLBA security risk, vendor oversight, and policy compliance. It’s user-friendly at first, but may feel limited as risk programs grow more complex. |

| Strengths | ✅ Strong onboarding support and easy-to-use templates for GLBA and FFIEC-aligned assessments

✅ Helpful for managing basic IT risk assessments and audit readiness across departments |

| Limitations | ⚠️ May lack flexibility for teams that need detailed IT asset assessments or real-time security oversight

⚠️ Hard to scale across larger banking environments or more technical security workflows |

| When to Consider | If you’re starting a structured IT risk management program in a small or mid-sized financial institution, and can work around limited scalability and customization options. |

| Other Comparisons | Quantivate vs LogicManager vs Isora GRC |

What Our Customers Say About Isora GRC

Security teams at top institutions are using Isora GRC to replace legacy tools and manual processes with intuitive workflows and actionable insight.

“Moving from manual processes to using Isora was a breath of fresh air. What used to take months is now automated, reliable, and defensible. Isora saves us significant time while delivering accurate insights that improve decision-making.”

Jessica Sandy, IT GRC Manager, The University of Chicago

“Isora has been essential in helping us meet our University of California cybersecurity requirements across a decentralized campus. Automating assessment data collection and reporting has given us clear visibility into unit-level risks, enabling us to prioritize resources effectively and address gaps with confidence.”

Allison Henry, CISO, The University of California, Berkeley

FAQs

What is the best GRC platform to help banks and financial institutions manage cybersecurity risk and streamline IT risk processes?

Top-rated IT GRC tools for financial services, including Isora GRC, Archer IRM, and LogicGate, help banks manage complex regulatory requirements (GLBA, FFIEC) and streamline IT risk processes such as conducting structured security risk assessments, managing third-party vendors, and preparing effectively for regulatory audits from the FTC, FDIC, OCC, CFPB, and NCUA.

How do banks, credit unions, and other financial institutions perform IT risk assessments to meet regulatory requirements like the FTC, FDIC, OCC, CFPB, and NCUA audits?

Financial institutions use specialized IT risk assessment software to align internal processes with regulatory frameworks (GLBA Safeguards Rule, FFIEC guidelines). These platforms automate risk identification, provide structured workflows, maintain detailed documentation, and simplify evidence collection, critical during rigorous regulatory audits.

Which GRC platforms support FFIEC cybersecurity guidelines and help banks manage compliance frameworks effectively?

Platforms specifically aligned with FFIEC cybersecurity guidelines, such as Isora GRC, provide standardized workflows, built-in controls mapping, comprehensive IT asset management, and automated compliance reporting to streamline FFIEC-aligned audits and reduce manual effort.

What’s the difference between IT risk management software and general risk assessment tools?

IT risk management software provides structured capabilities focused explicitly on managing data, hardware, and software risks, cybersecurity compliance, vendor management, and regulatory reporting. In contrast, general risk assessment tools may cover broader organizational risk workflows without a specialized focus needed for IT-specific regulatory frameworks such as GLBA or FFIEC.

How can financial services firms manage third-party vendor risk effectively?

Financial institutions should adopt specialized software to conduct comprehensive third-party security assessments, create useful risk reports, maintain vendor risk registers, and track remediations. These capabilities help banks and credit unions comply with regulatory demands and maintain visibility into risks presented by external vendors.

How can IT risk management platforms help financial institutions protect sensitive data and track security controls efficiently?

Effective IT risk management platforms offer centralized asset inventories, continuous security risk assessments, structured compliance processes, and integrated control frameworks (GLBA, FFIEC, NIST CSF, etc.). This ensures consistent tracking of security controls, swift response to identified risks, and reliable protection of sensitive data across the institution.

What’s the best risk register software for financial services organizations?

Risk register software like Isora GRC provides financial institutions with structured risk tracking, scoring, documentation, and exception management tailored to the rigorous demands of banking regulations (GLBA Safeguards Rule, FFIEC standards). The platform simplifies collaboration and ensures accountability and remediation clarity across the organization.

Which IT risk management platforms are recommended for non-bank financial institutions?

Non-bank financial institutions benefit from scalable, flexible IT risk management software like Isora GRC, which streamlines compliance, manages third-party vendor risks, simplifies internal and external security assessments, and aligns closely with common regulatory frameworks (GLBA, CFPB, FTC).

This content is for informational purposes only and does not constitute legal or compliance advice. See our full disclaimer.